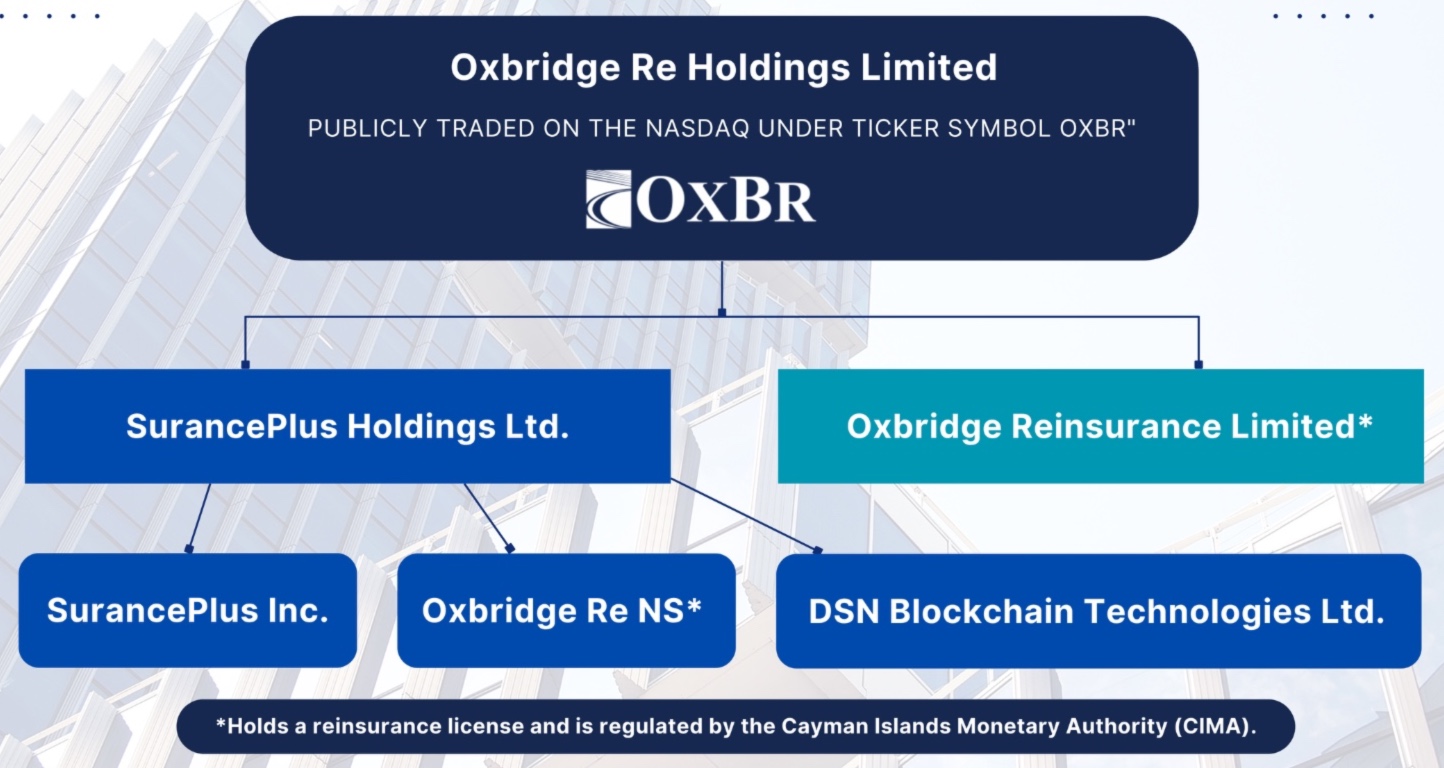

Pioneering Through Our Specialized Entities

SurancePlus * Oxbridge Re NS * Oxbridge Reinsurance Ltd.

Our group structure is designed to innovate and deliver value across the reinsurance and digital asset spectrum.

SurancePlus Inc.

SurancePlus is a new wholly owned Web3-focused subsidiary of Oxbridge Re Holdings Limited that specializes in Real-World Asset (“RWA”) tokenization.

It issued the DeltaCat Re digital security, the first of its multi-year Cat Re (short for “Catastrophe Reinsurance”) token series, in 2023 on the Avalanche Blockchain. Investors in DeltaCat Re are expected to receive a 42% annualized return on their investment.

Oxbridge Re NS

Oxbridge Re NS provides investors access to reinsurance contracts as a high-return alternative investment opportunity. Investors are offered attractive potential annualized returns of ~20% to 40%, where returns follow the fortunes of the reinsurance contracts and are uncorrelated to the volatility of the financial markets. Any potential losses are capped to the limit of the reinsurance contract and the investor’s investment.

Reinsurance contracts associated with the investment fully collateralized, and investors have the option to request a redemption at the end of each treaty year with no penalty.

Oxbridge Reinsurance Ltd.

Oxbridge Reinsurance Limited is a Cayman Islands licensed reinsurance entity that focuses on the U.S. Gulf Coast property and casualty (P&C) market. P&C insurance companies transfer risk through reinsurance.

Oxbridge Reinsurance offers fully collateralized reinsurance contracts with monies securely held in trust accounts in the United States.

Being fully collateralized, Oxbridge Reinsurance’s contracts have the highest possible ratings with no credit risk.